All Categories

Featured

Table of Contents

It is very important to note that your cash is not directly purchased the stock exchange. You can take money from your IUL anytime, but charges and surrender costs may be associated with doing so. If you require to access the funds in your IUL plan, considering the benefits and drawbacks of a withdrawal or a finance is vital.

Unlike direct financial investments in the securities market, your money value is not directly purchased the underlying index. università telematica iul. Instead, the insurer makes use of monetary tools like choices to connect your money value development to the index's efficiency. One of the distinct functions of IUL is the cap and floor rates

The fatality advantage can be a set amount or can include the money value, depending on the plan's framework. The cash worth in an IUL plan expands on a tax-deferred basis.

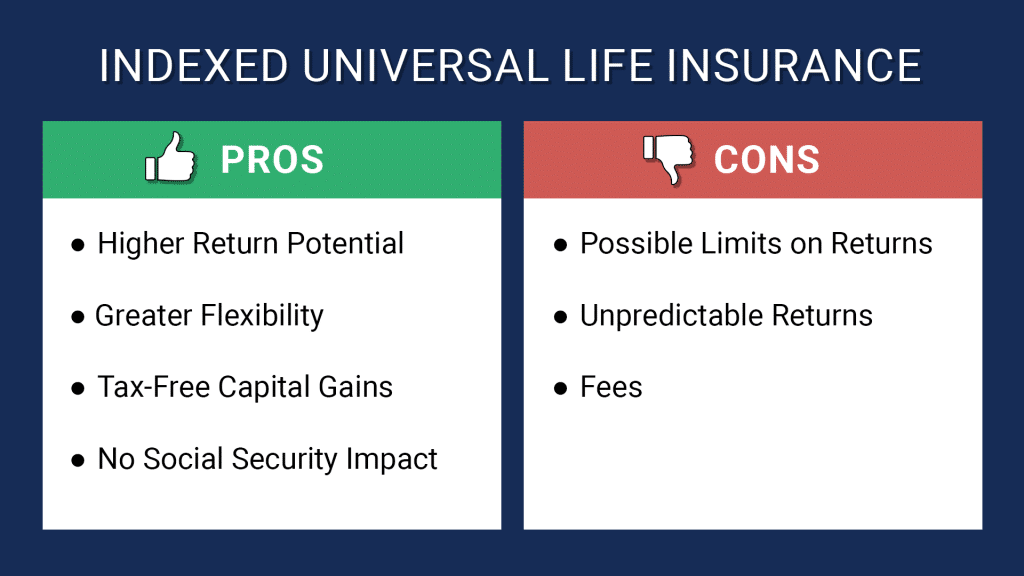

Always assess the policy's details and seek advice from with an insurance coverage specialist to fully comprehend the benefits, restrictions, and prices. An Indexed Universal Life Insurance policy (IUL) provides a special mix of features that can make it an attractive option for particular people. Here are a few of the essential benefits:: Among one of the most appealing facets of IUL is the potential for greater returns compared to other types of long-term life insurance policy.

Withdrawing or taking a financing from your policy may lower its cash money value, fatality benefit, and have tax obligation implications.: For those curious about legacy preparation, IUL can be structured to provide a tax-efficient way to pass wealth to the following generation. The fatality benefit can cover inheritance tax, and the cash worth can be an additional inheritance.

Iul Training

While Indexed Universal Life Insurance Policy (IUL) supplies a series of benefits, it's necessary to think about the possible disadvantages to make an educated decision. Below are some of the vital negative aspects: IUL policies are extra complex than conventional term life insurance policies or entire life insurance policy plans. Recognizing how the money value is connected to a supply market index and the effects of cap and flooring rates can be challenging for the average consumer.

The costs cover not only the expense of the insurance yet likewise management fees and the investment component, making it a more expensive option. While the cash worth has the capacity for growth based on a stock market index, that development is frequently covered. If the index executes extremely well in a given year, your gains will be limited to the cap rate specified in your policy.

: Including optional features or bikers can raise the cost.: How the policy is structured, consisting of how the cash money value is allocated, can likewise influence the cost.: Different insurance provider have different pricing models, so searching is wise.: These are fees for handling the plan and are typically subtracted from the cash worth.

IUL policies is an excellent choice for retirement planning. Building your future is easier with the right Indexed Universal Life policy. With tax-deferred growth and potential tax-free withdrawals.

IUL policies are tied to stock market performance, ensuring potential returns without risking your principal. Brokers help customize IUL policies for long-term financial needs. With premium flexibility and emergency access, Indexed Universal Life adapts to changing needs.

Whether you’re starting to save or preserving wealth, Indexed Universal Life offers a robust foundation (best IUL for business owners from agents). Speak with an IUL expert today to explore retirement planning with IUL

Iul Pros And Cons

: The costs can be comparable, but IUL offers a floor to assist shield against market declines, which variable life insurance policy policies normally do not. It isn't simple to provide a precise cost without a specific quote, as rates can differ substantially between insurance coverage providers and private scenarios. It's important to stabilize the value of life insurance policy and the demand for added protection it offers with possibly greater premiums.

They can help you understand the expenses and whether an IUL plan aligns with your financial objectives and needs. Whether Indexed Universal Life Insurance Policy (IUL) is "worth it" is subjective and depends upon your economic goals, danger resistance, and lasting planning needs. Right here are some indicate think about:: If you're seeking a long-lasting investment lorry that offers a fatality benefit, IUL can be an excellent option.

(IUL) plan. Comprehending the difference between IUL vs. 401(k) will certainly assist you plan effectively for retirement and your family members's financial wellness.

Iul Vs 401(k): A Comprehensive Comparison

In this situation, all withdrawals are tax-free because you have actually already paid taxes on that particular revenue. When you pass away, the funds in your 401(k) account will certainly be moved to your recipient. If you do not assign a beneficiary, the cash in your account will certainly come to be component of your to repay any kind of exceptional financial obligation.

You might grow your Roth IRA account and leave all the cash to your recipients. In enhancement, Roth IRAs offer more financial investment options than Roth 401(k) plans. Your only alternatives on a Roth 401(k) plan are those offered by your plan provider with.The disadvantage of a Roth Individual retirement account is that there's an earnings limitation on that can contribute to an account.

This isn't an attribute of a Roth IRA. Considering that 401(k) plans and Index Universal Life insurance policy function in different ways, your cost savings for each depend upon distinct variables. When contrasting IUL vs. 401(k), the first step is to understand the overall function of retirement funds contrasted to insurance policy advantages. Your retirement funds must have the ability to sustain you (and your partner or family members) for a few years after you quit functioning.

You need to approximate your retired life requires based on your present revenue and the standard of living you want to keep during your retired life. Typically, the cost of living increases every 20 years. You can use this rising cost of living calculator for more precise outcomes. If you discover 80% of your existing annual income and multiply that by 2, you'll obtain a quote of the amount you'll need to endure if you retire within the next two years.

We intend to present here to make the computation easier. If you withdraw roughly 4% of your retirement revenue yearly (considering rising cost of living), the funds ought to last regarding three decades. On the other hand, when comparing IUL vs. 401(k), the worth of your Index Universal Life Insurance plan depends upon variables such as; Your current earnings; The approximated expense of your funeral expenses; The size of your household; and The earnings streams in your home (whether another person is utilized or not). The even more recipients you wish to support, the even more money needs to approach your fatality advantages.

Indexed Universal Life Vs 401(k): Which Is Better For Your Estate Planning?

In truth, you don't have much control over their allocation. The main objective of irreversible life insurance policy is to supply extra economic support for your family members after you die. Although you can withdraw cash from your cash money value make up personal requirements, your insurance provider will certainly subtract that quantity from your death advantages.

A 401(k) provides revenue protection after retired life. Each serves a different objective. That's not to say you require to pick between IUL vs. 401(k). You can have both an Index Universal Life Insurance coverage policy and a 401(k) retired life account. However, you need to recognize that the regards to these policies transform each year.

Ready to get begun? We're below for you! Schedule a complimentary consultation with me now!.?.!! I'll respond to all your inquiries about Index Universal Life Insurance Policy and just how you can accomplish riches prior to retirement.

Table of Contents

Latest Posts

Death Benefit Option 1

Index Ul Vs Whole Life

Seguros Universal Insurance

More

Latest Posts

Death Benefit Option 1

Index Ul Vs Whole Life

Seguros Universal Insurance