All Categories

Featured

These policies can be much more complicated compared to various other types of life insurance coverage, and they aren't always best for every investor. Speaking to a skilled life insurance policy agent or broker can help you choose if indexed global life insurance policy is a great fit for you. Investopedia does not provide tax, financial investment, or economic solutions and guidance.

, including a long-term life policy to their financial investment profile may make feeling.

Low prices of return: Recent study found that over a nine-year period, staff member 401(k)s expanded by an average of 15.6% each year. Compare that to a set rate of interest of 2%-3% on an irreversible life plan. These differences accumulate gradually. Applied to $50,000 in cost savings, the fees above would amount to $285 per year in a 401(k) vs.

In the exact same vein, you could see financial investment development of $7,950 a year at 15.6% interest with a 401(k) contrasted to $1,500 annually at 3% interest, and you would certainly spend $855 even more on life insurance coverage each month to have entire life insurance coverage. For lots of people, obtaining irreversible life insurance coverage as component of a retirement is not a great idea.

IUL insurance is an excellent choice for retirement planning. Planning your retirement is easier with the right IUL policy. Offering both protection and growth, IUL helps secure your financial future.

Indexed Universal Life policies are tied to stock market performance, providing stability with growth. Insurance agents can design a policy tailored to your retirement goals. Options like living benefits and loan features add flexibility.

For professionals and retirees alike, IUL offers a robust foundation (tax-advantaged IUL plans through brokers). Speak with an IUL expert today to secure your future today

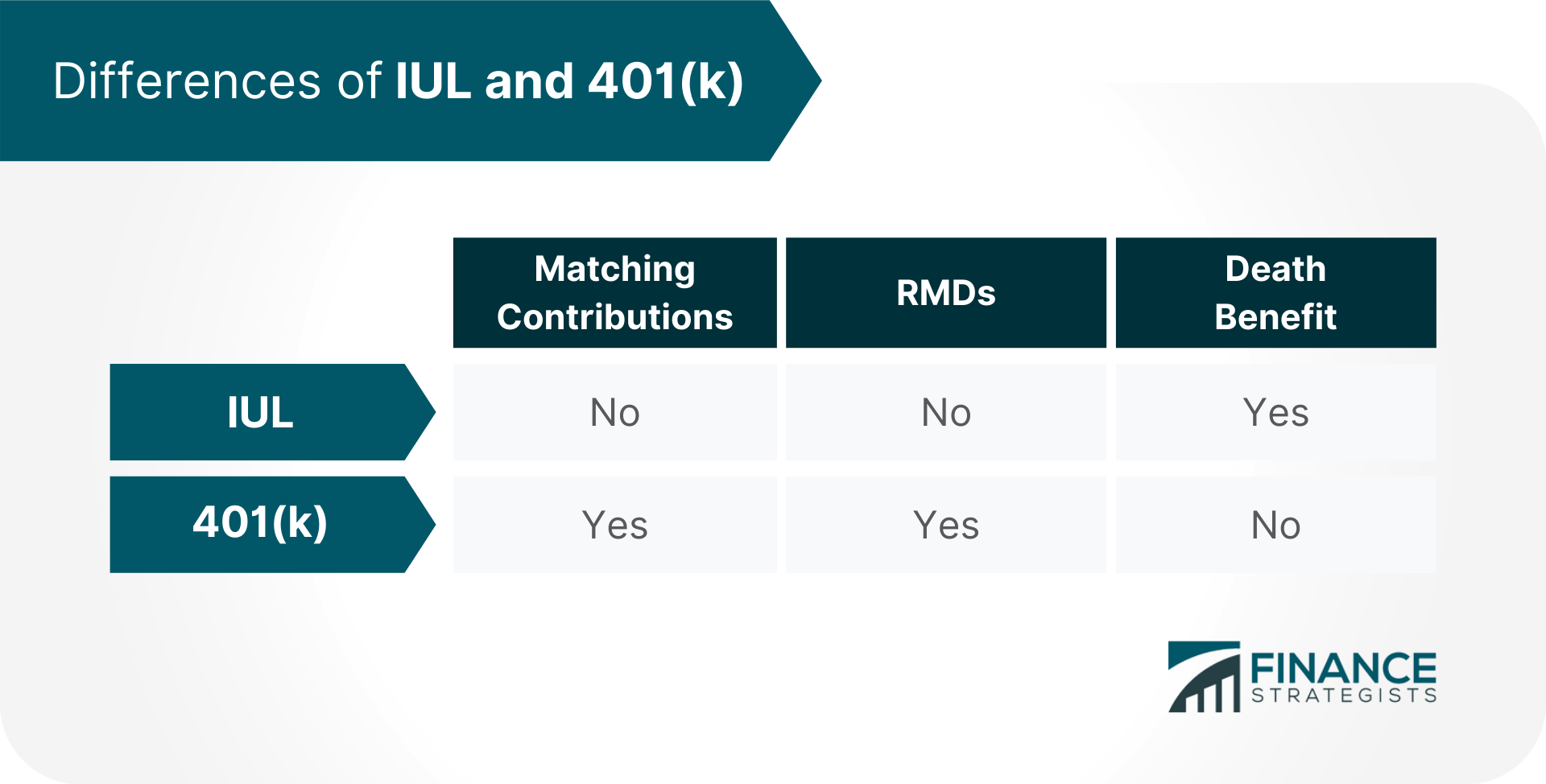

401(k) Vs. Indexed Universal Life Insurance: Which Is Better For Income?

Below are 2 common kinds of irreversible life plans that can be used as an LIRP. Whole life insurance policy offers dealt with costs and cash money worth that grows at a fixed rate set by the insurance provider. Traditional financial investment accounts generally offer higher returns and more versatility than entire life insurance policy, but entire life can offer a fairly low-risk supplement to these retirement savings approaches, as long as you're certain you can pay for the costs for the life time of the policy or in this situation, until retired life.

Latest Posts

Death Benefit Option 1

Index Ul Vs Whole Life

Seguros Universal Insurance